Cost Of Facebook Ads Are Down?

- Jason Burlin

- Sep 17, 2022

- 6 min read

Updated: Sep 8, 2023

Advertising, since the start of the COVID era, has been a wild ride for advertisers. It started with extreme concerns over the future of ecommerce, as the shutdown of the world posed a potential threat. No flights and no freight all caused a dramatic increase in shipping and transportation costs that sent the biggest names in ecommerce looking for solutions. It was a scary time for everyone, especially for advertisers and ecommerce owners who were already struggling to turn a profit from their businesses.

Then came the government stimulus packages help, along with the fact that offline retail was mostly shut down in most places around the world. Performance overnight sky-rocketed to levels that dramatically surpassed previous yearly events, like Black Friday or Cyber Mondays. In the first few weeks, no one knew if this was something that was happening globally, or just happening for their specific business. Soon enough, the news was everywhere and most companies who could operate online during the pandemic experienced growth and advertising performance that was beyond unimaginable. Record breaking numbers, and dramatic increases in advertising spend, caused an inflation in the cost to advertise on most advertising platforms around the world.

Looking back now, it is quite easy to analyze what happened– offline retail was mostly shut down and people were forced to stay at home. Governments were issuing unprecedented stimulus packages to both businesses and people. So what do people do with all of this free time and money? Spend it on products online, instead of saving for a potential global recession.

During that time, the first thing that Facebook advertisers noticed on the ad level, was the number of purchases from users compared to the number of clicks (AKA ad conversion rate). Companies saw dramatic increases in the number of conversions per day that their ads were generating, and that meant that they were investing more money into their ads, on Facebook. This created a domino effect where advertisers started doubling, and tripling, their monthly spend to capitalize on the fact that this moment was the best time to advertise and it caused the cost of advertising to dramatically increase.

If you are not familiar with how advertising platforms, like Facebook, bill their advertisers, it’s actually really simple. The cost to advertise is set by the cost per 1000 impressions. Facebook delivers 1000 ad impressions to users and it charges a fixed fee for those impressions. It doesn’t matter what results these impressions produce, companies are billed for them regardless. The cost for each 1000 impressions changes based on the users targeted, their demographics, location, and how many other advertisers are targeting the same users. There are millions of ad actions, every minute on Facebook that are automated by the Facebook algorithm that sets the price for each 1000 impressions based on a lot of factors. Basically, it’s automated; it is regulated based on supply and demand between the amount of money advertisers are willing to spend, the amount of available ad inventory set by how many users are active in the platform and how many ads can be shown to them. You can’t dictate who you specifically want to target on Facebook ads, but you can select the demographics, the geographical location, some general interests, and behaviors that are estimated to be somewhat relevant. So, the cost to advertise is regulated by the cost per 1000 impressions, which is set by Facebook and the level of competition; what will drive that cost up, or down, is how many advertisers compete for every ad space.

Because companies received such great results during the peak of the pandemic, they expanded their marketing infrastructure with more advertising spend, more people, and more resources. They expected these results to last for a long period of time, and planned for this growth to be continuous so they allocated more and more advertising spend. The increased cost of advertising didn’t catch advertisers by surprise and didn’t really matter to them because they were producing a lot more revenue, as well. Think of it as paying more money for an investment, or a service, but also getting a lot better returns on the investment. The increase of cost was not a concern as long as the increase in performance followed in a parallel basis, which for a long period of time it did, until it started to crack.

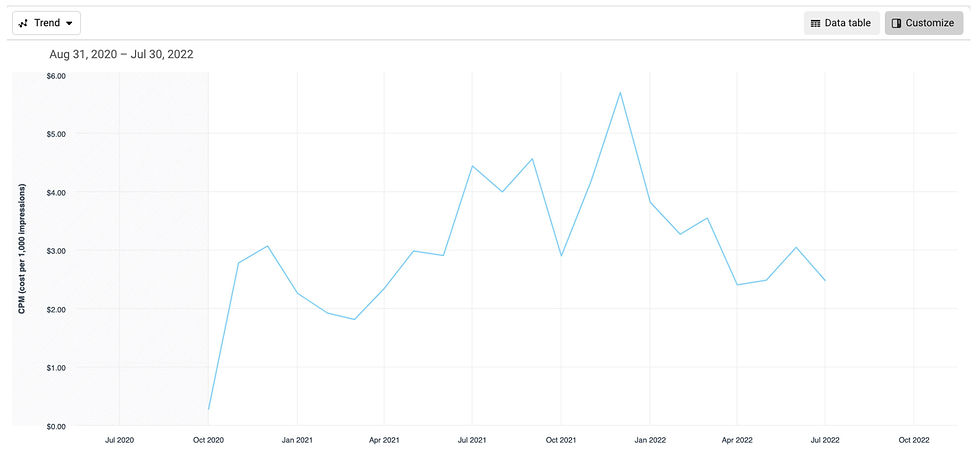

Facebook doesn’t share publicly the cost to advertise (current CPMs) on its platform, so if you are not currently advertising, it’s hard to tell. There are third party tools that collect this data through providing a service to advertisers on Facebook, but that data can be skewed to specific industries, or regions, or their reports just measure other metrics, such as, the cost per click or engagement. You can also get some good insights, if you are able to talk to someone who works at Facebook, within the ads platform. They get access to private data and normally dont mind sharing parts of it. I personally get access to first hand data from advertising accounts that I manage through my marketing company, but also through a bunch of different data points that I have direct, or indirect, access to. I plug the information together, and I am able to see insights on a holistic level to see the true movements of both ad cost and ad performance. Yes, my data is not truly sampled, and is not guaranteed to be correlated to the entire market, but for a simple marketer like myself, it’s massive amounts of juicy data.

Screenshot of global market.

Screenshot of the US market

What’s fascinating is to see the similarities between the cost to advertise and the performance of the stock market, or Nasdaq, in this case.

Some good news.

Everytime I finish writing an article, and read it again, it feels like it ends up being more negative, and less optimistic, than how I envisioned it before I started writing it. So there is good news here. After a very challenging two years, for most advertisers where the cost to advertise was really high, yet the efficiency was low, it looks like the cost to advertise is starting to fall back down. A recent sampling of data that I have access to shows that starting in July, we are noting a decrease in CPMS of anywhere from 14-40%, depending on the market and audience. This is pretty wild. The percentage decreases also depend on how expensive the market was previously. It seems that the more expensive, the bigger the drop is. This was expected by many, at some point, as the cost to advertise was so inflated, making advertising inefficient. To many experts it was not a question of will the cost go down, it was only a question of when. It was a question of how long advertisers could take spending the same amounts of money, with a decrease in overall performance, before they dramatically start pulling back spend. It looks like July marks the month where that negative trend in ad cost started to get noticed. I wish I had a way to predict the future cost of advertising, and all this optimism could be blown away in the next few months, as the holiday season is just around the corner. Historically, it’s the strongest period for ecommerce, but in this crazy world, who knows…

Actions to take –

Now that we covered the good, the bad, and the great, let’s talk about what you can do right now for your business.

The first thing that you want to check is whether or not the ad cost in your market is dropping or not. If you are advertising right now, it’s easy to check, simply pull up a chart with your ad cost sorted by month, and check to see if the cost per impression on your ad account is decreasing or not. If you are not advertising, or have stopped advertising, now might be a good time to get back in the ring. In my opinion, timing is everything in advertising. If the cost dropped in your market to a point where it might be profitable for you to run ads again, or scale your advertising spend, this is something that you need to check now.

The second thing is that you want to start looking at your advertising performance on a holistic level. Start evaluating advertising performance based on the largest sums of data. You want to start evaluating large time frames so you can assess when the best time is for your business to spend the majority of its marketing budget. It might not be when you think it is, it could be more tied to the cost to advertise, not tied to the seasons or a holiday event. Knowing when it’s most profitable for your business to advertise will help you plan a better, and more effective, advertising strategy for your business. You don’t have to spend a similar average per day, per week, or even per month, for your advertising to be effective. You have to double down, and seize the advertising opportunities when they are there. When you look back, you won’t remember how it was last Monday or last November, you will analyze the entire year and will ask yourself did you do better than the previous year or not.

In Summary.

The last two years have been a wild ride for Facebook ad sales. With the increase in online shopping, marketers found ample opportunity to reach a wider audience and, perhaps, more sales in the process. Facebook ad sales, much like the stock market, can go up or down depending on the supply and demand of services and spending habits of consumers. If you want to get an edge on sales, take a look at your ad sales within your market and take a more holistic view on your ad performance.

Comments